ERC-6960: Dual Layer Token

Token with a two-level classification system using mainId and subId

Metadata

Status: DraftStandards Track: ERCCreated: 2023-04-30

Authors

Adam Boudjemaa (@aboudjem), Mohamad Hammoud (@mohamadhammoud), Nawar Hisso (@nawar-hisso), Khawla Hassan (@khawlahssn), Mohammad Zakeri Rad (@zakrad), Ashish Sood ([email protected])

Abstract

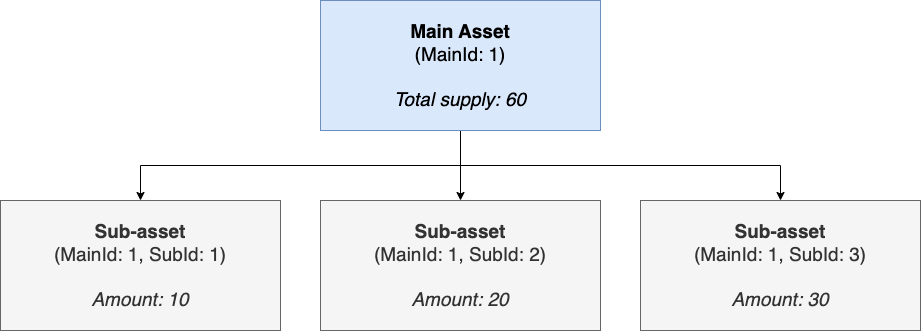

The dual-layer token combines the functionalities of ERC-20, ERC-721, and ERC-1155 while adding a classification layer that uses mainId as the main asset type identifier and subId as the unique attributes or variations of the main asset.

The proposed token aims to offer more granularity in token management, facilitating a well-organized token ecosystem and simplifying the process of tracking tokens within a contract. This standard is particularly useful for tokenizing and enabling the fractional ownership of Real World Assets (RWAs). It also allows for efficient and flexible management of both fungible and non-fungible assets.

The following are examples of assets that the DLT standard can represent fractional ownership of:

- Invoices

- Company stocks

- Digital collectibles

- Real estate

Motivation

The ERC-1155 standard has experienced considerable adoption within the Ethereum ecosystem; however, its design exhibits constraints when handling tokens with multiple classifications, particularly in relation to Real World Assets (RWAs) and fractionalization of assets.

This EIP strives to overcome this limitation by proposing a token standard incorporating a dual-layer classification system, allowing for enhanced organization and management of tokens, especially in situations where additional sub-categorization of token types is necessary.

Specification

The key words "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY", and "OPTIONAL" in this document are to be interpreted as described in RFC 2119 and RFC 8174.

DLT Interface

DLTReceiver Interface

Smart contracts MUST implement all the functions in the DLTReceiver interface to accept transfers.

Rationale

The two-level classification system introduced in this EIP allows for a more organized token ecosystem, enabling users to manage and track tokens with greater granularity. It is particularly useful for projects that require token classifications beyond the capabilities of the current ERC-1155 standard.

As assets can have various properties or variations, our smart contract design reflects this by assigning a mainId to each asset category and a unique subId to each derivative or sub-category. This approach expands the capabilities of ERC-1155 to support a broader range of assets with complex requirements. Additionally, it enables tracking of mainBalance for the main asset and subBalance for its sub-assets individual accounts.

The contract can be extended to support the use of subIds in two ways:

- Shared SubIds: where all mainIds share the same set of subIds.

- Mixed SubIds: where mainIds have unique sets of subIds.

DLT provides a more versatile solution compared to other token standards such as ERC-20, ERC-721, and ERC-1155 by effectively managing both fungible and non-fungible assets within the same contract.

The following are questions that we considered during the design process:

- How to name the proposal? The standard introduces a two-level classification to tokens where one main asset (layer 1) can be further sub-divided into several sub-assets (layer 2) hence we decided to name it as "Dual-layer" token to reflect the hierarchical structure of the token classification.

- Should we limit the classification to two levels? The standard’s implementation maintains a mapping to track the total supply of each sub-asset. If we allow sub-assets to have their own children, it would be necessary to introduce additional methods to track each sub-asset, which would be impractical and increases the complexity of the contract.

- Should we extend the ERC-1155 standard? As the ERC-1155 standard is not designed to support a layered classification and requires significant modifications to do so, we concluded that it would not be appropriate to extend it for the dual-layer token standard. Hence, a standalone implementation would be a more suitable approach.

Backwards Compatibility

No backward compatibility issues found.

Security Considerations

Needs discussion.

Copyright

Copyright and related rights waived via CC0.